Scott & Wilkinson Blog | Archive 2021

Please select a news item listed below which may be of interest to you. Alternatively, please review our archives at the bottom of the page by year. If any of them are of interest and you require more information, please do not hesitate to contact the office.

£1 billion in support for businesses most impacted by Omicron across the UK

Date: 22/12/21

In response to the rapid spread of the Omicron variant, the Chancellor, Rishi Sunak has announced there will be an additional £1 billion support available to businesses in the UK who are most impacted. Read More

Lancaster City Council opens applications for their new Winter Grant Scheme

Date: 15/12/21

Lancaster City Council (LCC) has launched its new Winter Grant Scheme to help support businesses in the most affected sectors who continue to be severely financially impacted due to Covid restrictions. Read More

HMRC Issue Nudge Letters to UK Cryptocurrency Owners

Date: 25/11/21

HMRC has sent letters to taxpayers it has identified as holders of cryptoassets, such as BitCoin, encouraging them to consider their Capital Gains Tax (CGT) position when disposing of such assets. Read More

The Farming Equipment and Technology Fund (FETF)

Date: 17/11/21

Yesterday, the Rural Payments Agency announced The Farming Equipment and Technology Fund (FETF) which will provide investment towards specific items of equipment, aimed at improving productivity and efficiency for farming, horticultural and forestry... Read More

Meet the Team - Danielle Harrison

Date: 11/11/21

In June 2021 we were delighted to welcome Danielle Harrison to our accounts team. During this short time, Danielle has proven to be a fantastic addition to the firm. Read More

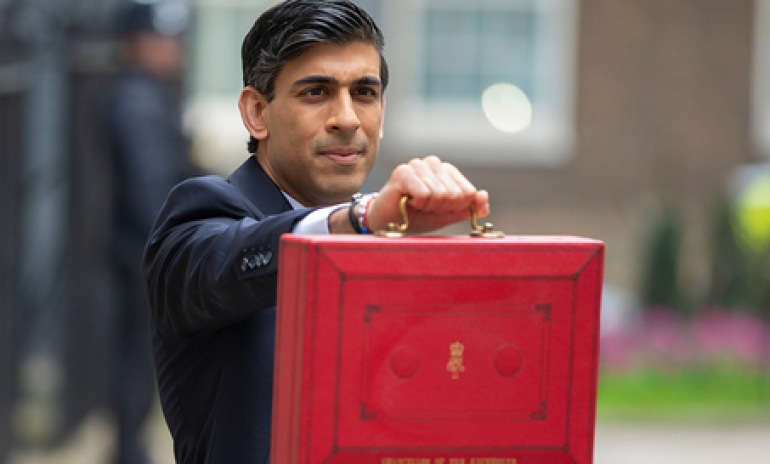

Autumn 2021 Budget and Spending Review

Date: 29/10/21

The Chancellor of the Exchequer, Rishi Sunak, announced his Budget to Parliament on Wednesday 27th October; the wider implications of which are sure to impact upon businesses across the UK. Read More

Extra time to prepare for MTD for Income Tax Self-Assessment

Date: 07/10/21

Recently HM Revenue and Customs (HMRC) announced that businesses will have an extra year to prepare for the digitalisation of Income Tax. Read More

Hospitality Industry – Increased VAT Rate

Date: 23/09/21

From 1 October 2021, there will be a further change to the temporary VAT rate for those in the hospitality industry making supplies of catering, holiday accommodation, and admissions to attractions. The VAT rate will increase from 5% to 12.5% for 6... Read More

Lancaster City Council Additional Restrictions Grants

Date: 22/09/21

Lancaster City Council has released two new Additional Restrictions Grants that are now available to support businesses impacted by the effects of Covid-19, including forced closures due to internal outbreaks of Covid-19. Read More

Xero UK Roadshow 2021

Date: 20/09/21

We attended the latest Xero Roadshow, held as a virtual event on 15 and 16 September, which provided an opportunity to learn about product updates and hear what Xero has in the pipeline for the coming months, along with interesting sessions... Read More

Tax changes to fund Health and Social Care

Date: 10/09/21

Recently the government announced tax changes to fund £12 billion a year to be spent on the NHS and social care across the UK. Read More

Xero Pricing Changes for UK Subscribers

Date: 24/08/21

From 23 September 2021, there are upcoming changes to Xero subscription pricing for UK business plan customers. Read More

Businesses advised to prepare for the Plastic Packaging Tax

Date: 04/08/21

The proposed new tax, which is expected to come into force in 2022, will require all businesses that manufacture or import 10 or more tonnes of plastic packaging over a 12-month period to register for the tax. Read More

Claiming the Fifth Self-Employment Income Support Scheme (SEISS) Grant

Date: 16/07/21

The rules for the fifth grant are similar to the fourth grant in most respects, however, they differ in terms of the level of grant that can be claimed is now dependent on the reduction in turnover of the individual claiming. Read More

Changes to the Coronavirus Job Retention Scheme (CJRS)

Date: 05/07/21

Changes to the CJRS scheme from July through to the end of September will result in employers having to cover a portion of the employee’s actual wages, as well as the national insurance and pension contributions. Read More

New VAT rules for e-commerce in the EU

Date: 28/06/21

On 1 July 2021, the EU will roll out three reforms under the ‘VAT E-commerce Package’, affecting online sellers who make sales to final consumers in the EU. Read More

How to setup Xero Multi-Factor Authentication (MFA)

Date: 27/05/21

For all of our clients currently using Xero cloud software for their bookkeeping, an additional security process is being introduced by Xero which will require you to verify yourself before accessing your data. Read More

New Super Deduction for Capital Allowances – What you Need to Know

Date: 10/05/21

As announced in the Budget 2021, the Treasury has introduced additional tax relief for certain plant and machinery purchased by companies. For costs incurred from 1 April 2021 until 31 March 2023, companies can claim 130% first-year capital... Read More

Claiming the Restart Grant

Date: 04/05/21

The Restart Grant will provide eligible businesses with a one-off payment to help reopen safely following the easing of restrictions. This grant is separate from all previous grants and so you will therefore have to submit a new application in order... Read More

Congratulations Michael Orford!

Date: 20/04/21

A massive congratulations are due to our very own Michael Orford who received the fantastic news that he passed his final exam and is now a member of the Association of Chartered Certified Accountants (ACCA). Read More

Are you eligible for the fourth Self-Employment Income Support Scheme (SEISS) Grant?

Date: 15/04/21

The fourth SEISS grant, which covers the period 1 February 2021 to 30 April 2021, is due to be launched later this month, find out if you are eligible and how you can claim. Read More

New Recovery Loan Scheme Launches

Date: 07/04/21

The new government-backed Recovery Loan Scheme will ensure businesses have continued finance available to them to recover following the end of previous COVID-19 loan schemes. Read More

Budget 2021: What has been announced?

Date: 03/03/21

Today the Chancellor, Rishi Sunak, presented his second budget very much recognising that we are still in the depths of the pandemic and that the Government must continue to support the economy. He did however set out a timetable for a number of... Read More

What changes are happening to off-payroll working rules (IR35) and how does it affect you?

Date: 01/03/21

The changes to IR35 mean that the responsibility for determining whether the off-payroll working rules apply will shift from the contractor’s PSC to the client organisation engaging them. If the rules apply, the client organisation, or the... Read More

Self Assessment late payment penalty to be waived if tax paid or payment plan set up by 1 April 2021

Date: 23/02/21

Self Assessment taxpayers will not be charged the 5% late payment penalty if they pay their tax or set up a payment plan by 1 April 2021. Read More

How to pay VAT deferred due to COVID-19

Date: 17/02/21

If you deferred VAT payments due between 20 March and 30 June 2020 and you still have payments to make, you can join the VAT deferral new payment scheme which opens from 23 February up to and including 21 June 2021. Read More

The SME Brexit Support Fund

Date: 15/02/21

Small and medium-sized businesses (SMEs) importing and exporting goods between Great Britain and the EU or moving goods between Great Britain and Northern Ireland may be eligible for a grant worth up to £2,000. Read More

£4.6 billion in new lockdown grants

Date: 05/01/21

The new grant will be a one-off grant for retail, hospitality and leisure businesses and will be paid in addition to the existing grants for closed businesses. Read More