Autumn 2021 Budget and Spending Review

Date: 29/10/21

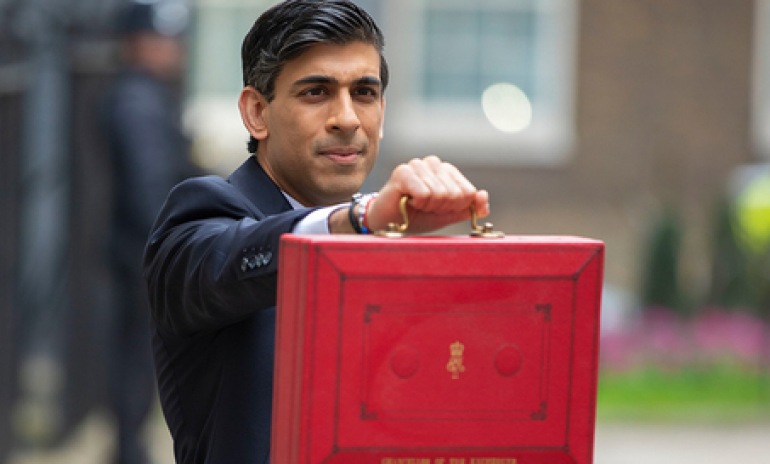

The Chancellor of the Exchequer, Rishi Sunak, announced his Budget to Parliament on Wednesday 27th October; the wider implications of which are sure to impact upon businesses across the UK.

The general tone from the Chancellor was an upbeat one with news that the economy has rebounded well from Coronavirus and that unemployment figures are lower than had previously been expected. Mr. Sunak was, therefore, able to avoid having to unveil further tax increases, such as to Capital Gains Tax or Inheritance Tax as had been previously predicted by many commentators.

Although there were no significant new tax rises announced, a rise in National Insurance Contributions (NICs) had already been announced last month ahead of the Budget. These are the 1.25% increase in NICs (to become the Social Care Levy), and the 1.25% increase in Dividend tax rates. This is on top of the previously announced increase in corporation tax which will take effect in two years’ time.

Aside from the taxation increases mentioned above, this Budget seems to be mostly about helping working people and businesses recover from the pandemic, and so has focused on spending.

The Business Rates changes should make things a little better for smaller high street retailers, as proposed increases to rates were cancelled and replaced with a 50% discount (up to £110,000) on 2022/23 rates bills for businesses in the retail, hospitality and leisure sectors. However, perhaps for retailers in particular, the more important issue for them is whether an Online Sales Tax will be introduced to shift some of the tax burden away from the high street and on to Online Retailers. Further to the rates discount, a new investment relief and exemption on rates were announced. The relief will mean that businesses will be able to make property improvements and pay no extra business rates for 12 months, whilst the exemption will exempt businesses from paying business rates for on-site use of renewable energy (such as solar panels) until 2035.

For businesses incurring expenditure on qualifying plant and machinery, the Chancellor announced a further extension of the £1m Annual Investment Allowance, meaning it is now not due to revert to the £200k limit until 1 April 2023. Whilst for many incorporated businesses this will be of little importance as they are likely to instead claim the super-deduction of 130%, the extension will still be welcomed by LLPs and unincorporated businesses that don’t qualify for the super-deduction.

There were more changes announced with respect to the administration of tax as the government takes further strides to make the tax system easier to administer and move closer towards ‘Making Tax Digital’. The changes will affect how trading profits made by self-employed individuals and partnerships are allocated to tax years. The changes mainly affect businesses that do not draw up annual accounts to 05 April or 31 March (being equivalent to 05 April), and would require apportionment of accounting profits into the tax years in which they arise should the business retain its existing accounting period. The new rules come into force from 6 April 2024 (aligned with the start date for MTD for Income Tax), although there are transitional rules in the 2023/24 tax year, designed to ease any cashflow impacts of the change.

Other tax administration changes include an increase in the reporting window for Capital Gains Tax on the sale of UK residential property not covered by a relief or exemption. The reporting requirement has been in since 6 April 2020 for UK tax resident individuals and previously required a return to be filed within 30-days of the sale of any UK property. However, for sales which complete on, or after, 27 October 2021, the reporting deadline and the payment of any associated tax is extended to 60 days.

The announced increase to the current National Living Wage for individuals with affect from 1 April 2022 will be welcomed by most low-income households, although there are fears this may add further inflationary pressures should businesses seek to recoup the increased cost through price rises.

Alongside this, the changes to the Universal Credit (“UC”) taper relief, which will see the rate reduced from 63% to 55%, should also make life better for working people on lower incomes as claimants will be able to keep an additional 8p for every £1 of net income they earn. However, people who can't work, and those not in UC, aren't going to see any of that benefit and may find things getting tougher.

Otherwise, this Budget is about rationalising things and tidying them up. The changes to alcohol duties make a lot of sense, though I suspect that drinkers of weak beer and low-strength wine will be the winners, and those who like cider, strong beer, and spirits might well find themselves paying a bit more - CAMRA may not see eye to eye with the WHO on this one. Similarly, with air passenger duty: domestic flights will be cheaper but long-haul flights will get hit, especially with the oil price going up in recent times.

And that really sums up the Budget, some sensible tidying up, a programme of spending increases and targeted tax cuts but, to be frank it's going to be petrol prices, inflation, and the supply chain that will have more impact on people over the next year or so. You'll need to save a lot of 3p's off your beer if you have to buy petrol at £1.60 a litre.

Author: Stuart Hinnigan FCA CTA

Stuart’s career in accountancy began when he joined Preston based Moore and Smalley in 1994 following his graduation from Lancaster University. He qualified as a Chartered Accountant in 1997 and then chose to specialise in...

0 Comment

Add your Comment

We have the ability to edit and/or delete posts and comments. Links should be relevant to the topics. Please note all comments are subject to review before inclusion.

Nobody has commented yet. Why not add one?